Carry Trades

The LME and CME are physically settled exchanges. This means that if you let a futures trade become prompt (expire) on the LME or CME, your futures trade will become a physical obligation to either receive metal if you are long futures, or deliver metal if you are short futures. The metal will need to be delivered in an exchange-approved warehouse, and be of an exchange-approved brand that meets the chemical specifications for that metal. These parcels are known as warrants and are discussed at much greater length in our book and courses.

While physically backed exchanges can be utilized in this fashion, most of the time trading companies do not want to allow a position to become prompt and have to receive metal from or deliver metal to the exchange.

Let’s say you bought 100MT of physical copper and priced it on the LME with a plan to sell this physical parcel at the beginning of June. When you hedged this purchase you placed your futures short position in June accordingly. Since you are buying and selling basis LME, this means your futures short sits on the third Wednesday of June.

Something happens that causes a delay in the shipping of your purchase until July - a delayed vessel perhaps, or an issue at the producer causes a slow-down in production, any number of common occurrences that might impact your ability to sell this metal when you had originally planned. Since you will no longer be able to sell this metal in June, you will also not be hedging a physical sale in June. In order to not be left with a futures short position that would create an obligation to deliver metal to the LME, companies move their futures position with something called a carry trade.

It is worth noting that for futures positions on the CME, because there is only one prompt date per month (the last business day of each month), your long or short position can be called upon as soon as the first business day of the month it sits in. Because of this, CME positions should be moved at the latest by the last business day of the month prior to the prompt month.

There are two types of carry trades, a borrow and a lend. Anytime you are buying a nearby prompt date and selling a prompt date further into the future, that is called a borrow. If you are selling a nearby prompt date and buying a prompt date further into the future, this is called a lend. In the above example in which your physical purchase was delayed, you would have to buy June third Wednesday futures to square your June short position, and sell July third Wednesday futures so you are now short July.

When you execute a borrow or a lend, you are executing both the buy and the sell trades at the same time. If you did not execute these two trades simultaneously, you would be creating outright price risk by going long or short that commodity.

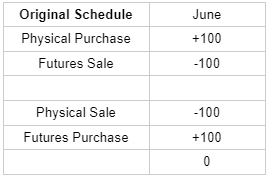

The following table shows your square June position from the original shipment schedule.

Square June Position

The below table shows the carry trade required due to the delay in purchase shipment from June to July.

Borrow from June to July

The highlighted cells above show your carry trade, a borrow in this case because you have bought June futures and sold July futures. Your physical is now square against your futures in July, and you no longer have a futures position in June.

If it were the case that instead of a physical purchase being delayed a physical sale was brought forward from June to May, you would need to lend, as shown in the following table.

Lend from May to June

The highlighted cells show your carry trade. You originally placed your physical purchase hedge in June because that’s where you believed your physical sale was going to take place and hence price. You have sold May futures and bought June futures to square your position in both months.

These examples are very simple versions of carry trades, but they are also the most important to understand so that you can develop your knowledge in order to build toward more complex situations that may arise in your day-to-day work.